Overview of OBBBA

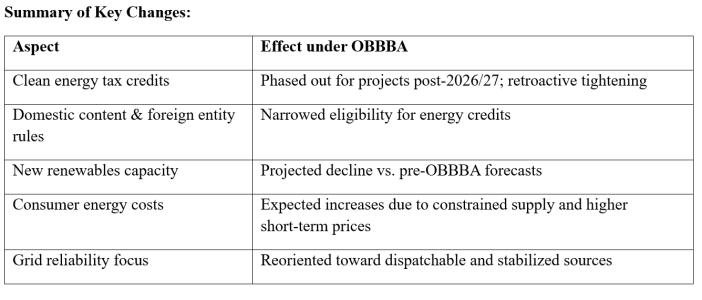

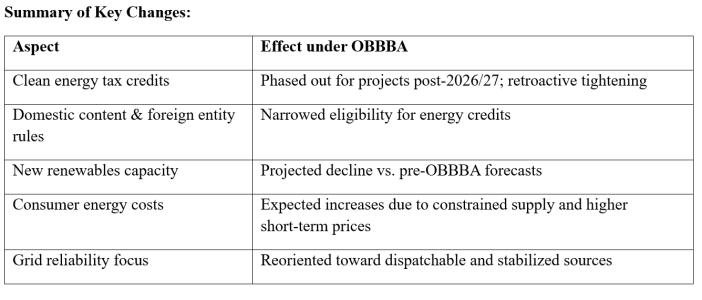

The One Big Beautiful Bill Act (OBBBA, H.R.1) was enacted on July 4, 2025, marking a substantial overhaul of U.S. energy and tax policy. Among its various provisions, the act notably rescinds or phases out several tax incentives established under the Inflation Reduction Act (IRA) of 2022, including clean electricity investment and production credits for solar and wind energy projects. Projects must now begin construction by mid-2026 or be operational by the end of 2027 to qualify for credits. Broader restrictions include tighter domestic content rules and exclusions for entities linked to certain foreign sources, drastically narrowing eligibility for tax benefits.

Impacts on Renewable Development Timelines

Under OBBBA, developers face significantly shortened timelines and stricter compliance thresholds to secure federal incentives. These changes raise material uncertainties for planning, financing, and execution of utility-scale and distributed solar and wind projects. Analysts warn of potentially 340 GW fewer new generation capacity additions over the coming decade, compared to prior forecasts angled under IRA incentives. This reduction is expected to suppress both private investment and clean energy job growth, especially in regions dependent on emerging renewables markets.

Cost and Market Consequences

The rollback of renewable tax credits is predicted to result in higher electricity costs for consumers, particularly in the South and Midwest. Estimates suggest annual household bills could increase by $40–$300 by 2030, and by $55–$640 by 2035, due to delayed power plant retirements and reduced clean generation capacity. Additionally, uncertainty introduced by OBBBA may delay corporate energy infrastructure projects, such as AI data centers, which rely on predictable clean power delivery.

Policy and Industry Dynamics

Proponents of OBBBA assert that the legislation restores focus on dispatchable power resources, including fossil fuels, nuclear, and grid reliability, while phasing out what is viewed as inequitable or unsustainable clean energy subsidies. Critics, however, argue that the legislation undermines U.S. leadership in climate innovation and renewable technology, increasing dependency on fossil fuels and potentially ceding clean energy competitiveness to other nations.

Discussion points for consideration:

References

Weil, Gotshal & Manges LLP (2025).

The One Big Beautiful Bill Act: Key Takeaways for Clean Energy Projects and Investment

McDermott Will & Emery LLP (2025).

The One Big Beautiful Bill Act: Navigating Clean Energy Tax Credits in a New Era

www.mwe.com

www.mwe.com

Wood Mackenzie (2025, July 4).

Trump’s One Big Beautiful Bill Act reshapes US energy landscape

www.woodmac.com

www.woodmac.com

Center on Global Energy Policy, Columbia University SIPA (2025).

Assessing the Energy Impacts of the One Big Beautiful Bill Act

www.energypolicy.columbia.edu

www.energypolicy.columbia.edu

MarketWatch (2025, July 8).

Why cheaper power looks unlikely as Trump’s big-budget law reshuffles the U.S. energy landscape

U.S. Congress (2025).

H.R.1 – One Big Beautiful Bill Act (OBBBA), 119th Congress

https://www.congress.gov/bill/119th-congress/house-bill/1

The One Big Beautiful Bill Act (OBBBA, H.R.1) was enacted on July 4, 2025, marking a substantial overhaul of U.S. energy and tax policy. Among its various provisions, the act notably rescinds or phases out several tax incentives established under the Inflation Reduction Act (IRA) of 2022, including clean electricity investment and production credits for solar and wind energy projects. Projects must now begin construction by mid-2026 or be operational by the end of 2027 to qualify for credits. Broader restrictions include tighter domestic content rules and exclusions for entities linked to certain foreign sources, drastically narrowing eligibility for tax benefits.

Impacts on Renewable Development Timelines

Under OBBBA, developers face significantly shortened timelines and stricter compliance thresholds to secure federal incentives. These changes raise material uncertainties for planning, financing, and execution of utility-scale and distributed solar and wind projects. Analysts warn of potentially 340 GW fewer new generation capacity additions over the coming decade, compared to prior forecasts angled under IRA incentives. This reduction is expected to suppress both private investment and clean energy job growth, especially in regions dependent on emerging renewables markets.

Cost and Market Consequences

The rollback of renewable tax credits is predicted to result in higher electricity costs for consumers, particularly in the South and Midwest. Estimates suggest annual household bills could increase by $40–$300 by 2030, and by $55–$640 by 2035, due to delayed power plant retirements and reduced clean generation capacity. Additionally, uncertainty introduced by OBBBA may delay corporate energy infrastructure projects, such as AI data centers, which rely on predictable clean power delivery.

Policy and Industry Dynamics

Proponents of OBBBA assert that the legislation restores focus on dispatchable power resources, including fossil fuels, nuclear, and grid reliability, while phasing out what is viewed as inequitable or unsustainable clean energy subsidies. Critics, however, argue that the legislation undermines U.S. leadership in climate innovation and renewable technology, increasing dependency on fossil fuels and potentially ceding clean energy competitiveness to other nations.

Discussion points for consideration:

- How can project developers adapt to rapid phase-out schedules for IRA-based credits?

- What role might localized or state-level incentives now play in sustaining solar and wind momentum?

- Can technological innovations, such as hybrid storage or community solar models, buffer the effects of federal policy changes?

References

Weil, Gotshal & Manges LLP (2025).

The One Big Beautiful Bill Act: Key Takeaways for Clean Energy Projects and Investment

McDermott Will & Emery LLP (2025).

The One Big Beautiful Bill Act: Navigating Clean Energy Tax Credits in a New Era

The One Big Beautiful Bill Act: Navigating clean energy tax credits in a new era

Explore the OBBBA's impact on clean energy tax credits and its implications for renewable energy project developers, producers, and investors.

Wood Mackenzie (2025, July 4).

Trump’s One Big Beautiful Bill Act reshapes US energy landscape

Trump's One Big Beautiful Bill Act reshapes US energy landscape | Wood Mackenzie

President Trump's One Big Beautiful Bill Act (OBBBA) represents a dramatic shift that will fundamentally reshape US energy markets. US power policy must adapt beyond OBBBA to ensure power supply growth across the US. Without these actions, the US risks losing its competitive edge in the global...

Center on Global Energy Policy, Columbia University SIPA (2025).

Assessing the Energy Impacts of the One Big Beautiful Bill Act

Assessing the Energy Impacts of the One Big Beautiful Bill Act - Center on Global Energy Policy at Columbia University SIPA | CGEP %

Get the latest as our experts share their insights on global energy policy.

MarketWatch (2025, July 8).

Why cheaper power looks unlikely as Trump’s big-budget law reshuffles the U.S. energy landscape

U.S. Congress (2025).

H.R.1 – One Big Beautiful Bill Act (OBBBA), 119th Congress

https://www.congress.gov/bill/119th-congress/house-bill/1