Our team at Provolt Energy recently completed a comprehensive technical scan of the EMS (Energy Management System) landscape for BESS deployments spanning utility-scale, C&I, hybrid, and specialized applications. Here’s a breakdown of what we found across the 2025 landscape.

Utility-Scale Grid Compliance (e.g. NERC CIP)

Utility-Scale Grid Compliance (e.g. NERC CIP)

Commercial & Industrial Automation

Commercial & Industrial Automation

Hybrid PV/Genset/BESS Controllers

Hybrid PV/Genset/BESS Controllers

Virtual Power Plants & eMobility

Virtual Power Plants & eMobility

Software-only EMS vs. Turnkey Integrators

Software-only EMS vs. Turnkey Integrators

Highlights by Category

Full matrix comparison also includes Nor-Cal, Siemens, Leclanché, Grid Kod, FlexGen, and more.

Match EMS to project type: grid-tied renewables ≠ microgrid ≠ VPP

Match EMS to project type: grid-tied renewables ≠ microgrid ≠ VPP

Prioritize interoperability (Modbus, IEC, REST)

Prioritize interoperability (Modbus, IEC, REST)

Forecasting matters: go AI/ML if optimizing merchant or DR revenue

Forecasting matters: go AI/ML if optimizing merchant or DR revenue

Don’t overlook deployment support—local field teams reduce delays

Don’t overlook deployment support—local field teams reduce delays

Full report available upon request.

Full report available upon request.

Would love to hear from folks who’ve deployed with any of these vendors—or if you have a sleeper EMS player worth watching in 2025.

Would love to hear from folks who’ve deployed with any of these vendors—or if you have a sleeper EMS player worth watching in 2025.

EMS Segments Covered:

Highlights by Category

UTILITY-SCALE

- Fractal EMS – On-prem/cloud hybrid with air-gapped security, ideal for PV+S and CIP-compliant sites.

- Nor-Cal Controls – Deep customization with SCADA/DERMS overlays, strong U.S. utility adoption.

- Siemens Energy – Scalable to GW-class systems via Xcelerator suite; global compliance standards.

- FlexGen – Tight EMS–PCS integration; known for ERCOT and SE market optimization.

C&I

- Wattstor – SCADA-grade control with auto load shifting; great for plug-and-play peak shaving.

- HIS Energy – AI-powered EMS with EV charging and TOU arbitrage built in.

- Motive Energy – Site-customized EMS designs, strong for industrial retrofits.

HYBRID & MICROGRID

- Elum Energy – Battery optimization across PV/diesel/genset systems; deep logging, fewer cloud tools.

- Grid Kod – Simple interface for Modbus/IEC-based integration; strong in emerging markets.

- Enel X – Global DRMS/EMS platform with multi-protocol support and revenue stacking tools.

SPECIALIZED / VPP / EV

- Codibly – Microservices-based EMS for eMobility and aggregators; API-first design.

- Acelerex REX EMS – AI-driven, modular EMS supporting both VPP pilots and residential rollouts.

- Leclanché – Strong on grid compliance, SCADA/DERMS support, and ISO market services.

- Stem – Athena AI platform with proven ISO revenue optimization in CAISO/ERCOT.

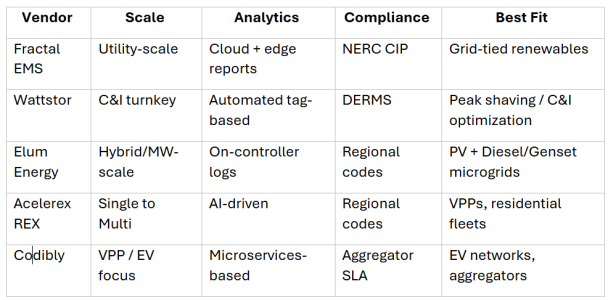

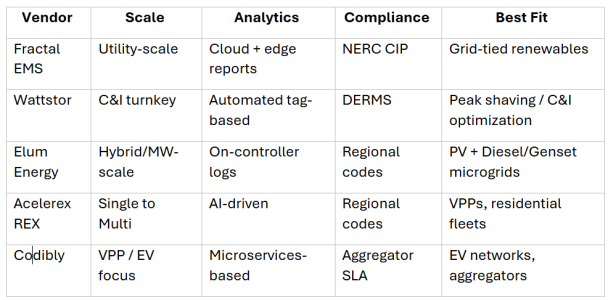

Comparative Snapshot

Full matrix comparison also includes Nor-Cal, Siemens, Leclanché, Grid Kod, FlexGen, and more.

Regional Notes:

- North America: Fractal EMS, Nor-Cal, Siemens, Stem, Leclanché

- Europe: Leclanché, Acelerex, Codibly, HIS Energy

- Asia-Pacific: Elum Energy, Siemens regional, emerging Fractal support

- Emerging Markets: Motive, Grid Kod via partner integrators

EMS Pricing Observations:

- Turnkey BESS (incl. EMS + PCS): China avg. ~$101/kWh

- Residential EMS systems: $300–$2,000/kWh depending on voltage, features, and integration